Beauty Salon and Barber Shop Payroll Software

Beauty salons and barber shops face a number of unique challenges when it comes to processing payroll. This is largely due to the fact that they do not operate in the same way as most other businesses. Employees working in a beauty salon or barber shop are typically paid according to work they perform for clients and as such, their payroll may vary from one pay period to another. Additionally, they may also have expenses that might be deducted from their pay, such as paying rent for space in the salon or barber shop. Overall, it can make calculating and administering payroll a challenge.

Beauty Salon and Barber Shop Payroll Made Easy

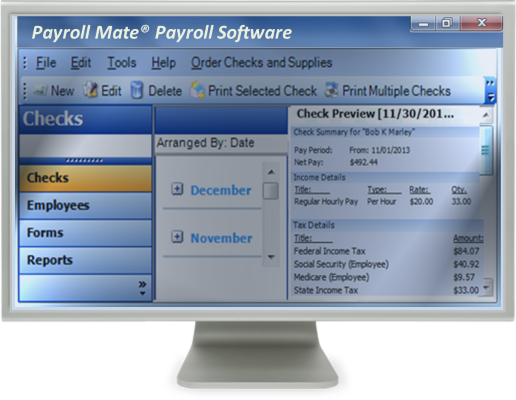

Rather than trying to handle the process manually, there is a better solution. Payroll Mate® is designed to make it easier to process payroll in your beauty salon or barber shop. Payroll Mate® can be configured to make payroll according to what makes the most sense for your shop.

Generates Federal Forms and Easy to Access Reports

• Calculating payroll and meeting withholding requirements also becomes easier with Payroll Mate®.

• Forms W-2, W-3, 940, 941, 943, and 944 are all supported by Payroll Mate®.

• You never need to worry about whether you have your federal quarterly and annual payroll forms properly completed. They are ready to sign and send.

• You can also take full advantage of the vast amount of reports offered by Payroll Mate® to understand more about your business or even to keep your shop more organized.

• Available reports include Employee Lists, Employee Earnings, Payroll Journal Summary, Tax Liability, Journal Detail, Taxes & Deductions, Pay Periods, State Taxes, Deposit Requirement, and many more.

• Reports can be printed or can be easily emailed.

• Payroll Mate® is even able to generate 1099 forms if you process payroll for 1099 Recipients. This is an additional cost add-on feature to Payroll Mate®.

Getting Started is Simple and Fast

• Setting up Payroll Mate® is also quite easy, as there are no worries about compatibility. Payroll Mate® works with a variety of Windows versions and can even work with MAC with virtualization technologies, such as Parallels Desktop or Oracle Virtual Box

• Payroll Mate® allows you to import pertinent employee information from a CSV file for easy payroll startup.

• Along with providing tutorials, Payroll Mate® also gives you the opportunity to receive friendly customer service via chat, email, or telephone, ensuring there is always help available if you need it.

• This solution allows you to export payroll data to accounting software applications, including Intuit QuickBooks, Peachtree Sage 50, Quicken and more.

Accurate Calculations

• One of the most challenging aspects for any business when administering payroll can be ensuring that Social Security, Unemployment, and Medicare deductions are calculated correctly.

• With Payroll Mate®, you do not have to worry that you have calculated these deductions incorrectly since it does it automatically for you.

• In addition, Payroll Mate® will also auto calculate sick and vacation time accrual.

Reliable Backup and Restore Feature

• Do you find that you sometimes forget to back up important information? With Payroll Mate®, you never have to worry about that again, as you are given an automatic reminder to back up your payroll data.

Other Important Features

• You can take advantage of the fact that you can not only administer different types of payroll but also different pay frequencies.

• Pay frequencies include daily, weekly, bi-weekly, semi-monthly, and monthly.

• Some payroll or income types include hourly, bonuses, commission, and salary.

• Print signature ready checks and print pay stubs for your employees. These pay stubs can easily be emailed to your employees as well.

• With an additional cost add-on feature to Payroll Mate®, you can also provide your employee with a convenient direct deposit option.

• Keeping information regarding payroll for your beauty salon confidential is made easy when you take advantage of the ability to password-protect your login. Whenever a user logs in, he or she will be prompted to enter a required password, thus ensuring that unauthorized users cannot gain access to confidential information.

• Payroll Mate® also gives you the option to hide sensitive information, such as social security numbers on pay stubs.

While operating a beauty salon and barber shop might have its challenges, Payroll Mate® can ensure that the process of administering payroll is not one of those challenges.

These are only some of the features of Payroll Mate. Please refer to the Payroll Mate payroll software page for more details.