Farm Payroll Software for Farmers, Ranchers and Employers of Agricultural Workers

Payroll Mate® makes paying farm employees and contractors easy and affordable.

Our payroll system caters to the special payroll processing needs of agricultural businesses including ability to pay employees per piece (per bucket), ability to generate form 943 and support for seasonal employees.

For $219 only, process payroll for up to 10 farm businesses, with up to 75 workers / employees per business for one calendar year.

Farm Payroll Made Easy

Payroll Mate offers all the features needed to run payroll for a farm in a fraction of the time needed to do the same task manually and in a fraction of the cost needed to use a farm payroll service.

Supports Form 943. Employer's Annual Tax Return for Agricultural Employees. This return is used by employers of agricultural workers for reporting FICA (SS and Medicare) and federal income taxes on wages paid.

Offers a "Deposit Requirements Report", which provides employers the information they need to make federal and state tax deposits. Rules for making deposits that apply to agricultural businesses resemble those for employers of nonagricultural workers (some exceptions apply, refer to form 943 instructions for more details).

Exports payroll data to farm accounting software including Intuit QuickBooks, Sage 50, Sage Peachtree, Microsoft Money, Quicken and many more.

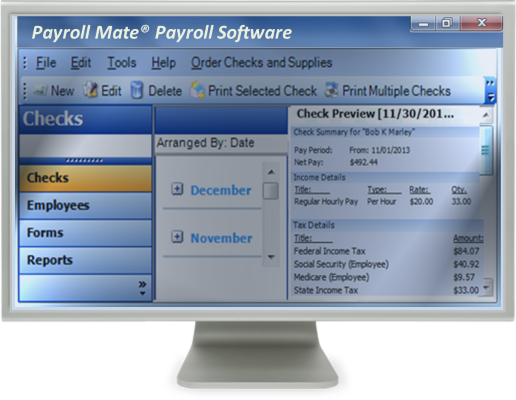

Prints checks and payroll check stubs with comprehensive information for your employees including income, deduction and tax details.

Ability to import payroll setup from other payroll accounting programs.

Designed for small farm owners with a few employees, large agricultural businesses with hundreds of employees and accountants doing payroll for multiple clients.

Pay by salary, hourly, per piece, overtime, double overtime, and commission or by any other custom payment type you might need to create.

Supports paying multiple per-piece and per-hour rates for the same employee.

Helps employers comply with IRS and state payroll record keeping requirements

Trusted by businesses and farm owners in all 50 states (and D.C) including California, Florida, Texas, Ohio, New York, Illinois, New Jersey, Alabama, Georgia, North Carolina, Pennsylvania, Massachusetts, Washington and more.

Supports paying farm labor contractors, full time employees, part-time employees, office managers and truck / tractor drivers.

These are only some of the features of Payroll Mate. Please refer to the Payroll Mate payroll software page for more details.

Video: Farm Payroll Software Features

This video discusses top features of our farm payroll software and how to download a free trial. This video is useful for farmers, ranchers and businesses in the agricultural community.