Municipal and Local Government Payroll Software

Payroll Mate is affordable and accurate payroll software that gives municipal and local governments all the features needed to process complex payroll in-house using desktop computers while saving time and money. Payroll Mate is ideal for payroll departments for different jurisdictions at the municipal level, including small cities, towns, boroughs, and villages. Pay union and non-union employees with different job classifications including full-time, part-time, temporary and auxiliary. Employees can be tracked under departments such as finance, utilities, recreation, roads, building services and engineering. Checks can be printed on regular check stock or on pre-printed checks with the ability to include a digital signature. Different payroll reports can also be generated to help with compliance and bookkeeping.

Pricing for Payroll Mate starts at $219 for one calendar year. A free trial can be downloaded to evaluate the software before purchase.

Municipallity Payroll Made Easy

Operating a municipality can be like operating a small country. When it comes to payroll, you will likely have a variety of employees to pay. This can include everyone from the office staff to the parks and recreation department. Although handling municipality payroll can present a number of challenges, those challenges can be mitigated with the right payroll processing software. Payroll Mate® provides a number of unique features that make it ideal for use in any size municipality.

As a municipality searching for a robust payroll processing software, you likely understand how important it is to ensure that you remain in compliance with federal and state requirements for payroll. This is naturally important for any business, but municipalities are often subject to even more scrutiny, so it is vital to ensure that everything is conducted above board. Payroll Mate® gives you the confidence in knowing that your payroll has been calculated accurately. A variety of robust features can help you to process your municipality payroll more accurately while also saving a tremendous amount of time and effort.

Automatically Calculate Taxes for Municipal Payroll

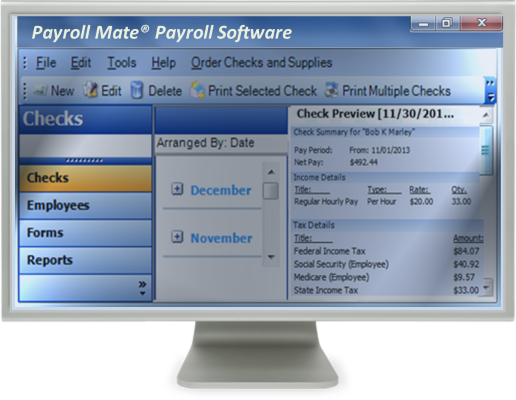

• One of the most important ways that Payroll Mate® can help you to save time and reduce effort is by calculating state and federal withholding taxes automatically. Social Security, Medicare, and the net pay is also calculated for you.

• Payroll Mate® provides you with the most recent tax tables to ensure calculations are always accurate.

• Do you need to apply a special tax or deduction to your employees? Easily custom create unlimited tax or deduction categories to ensure you can handle all types of payroll.

Handle Multiple Types of Municipal Pay Types and Frequencies

• In municipalities, it is not uncommon for employees to receive different pay types. It is even possible for employees to be paid on different payroll cycles.

• Pay frequencies include daily, weekly, bi-weekly, semi-monthly, and monthly.

• Pay types include hourly, overtime, bonuses, and many more.

• Payroll Mate® can help to cut through the confusion and ensure that everyone is paid on time and accurately.

• Do you need to pay your employees with a special income type? Easily custom create unlimited income categories to ensure you can handle any type of payroll.

Processing Payroll

• Payroll checks can be printed on compatible pre-printed checks or on blank paper with an additional cost add-on feature. Signature ready checks can be printed in a matter of minutes.

• Do you prefer direct deposit? This can be supported with an additional cost add-on feature.

• Regardless of the option you choose, employee’s pay stubs can be easily printed or emailed.

• Payroll Mate® supports tracking and accruing two different types of leave; both sick hours and vacation hours. Time can be accrued per check or by the total hours on the check. Hours earned and used can also be printed on employee’s pay stubs.

• Need assistance while processing payroll? Friendly customer support is available via live chat, email, and phone. The software also provides you with built in tutorials and wizards to assist you along the way.

• Payroll insight can be obtained by pulling multiple payroll reports including Payroll Journal Detail, Pay Periods, Taxes and Deduction, State Taxes, and many more.

Supports a Variety of Federal and State Forms

• Payroll Mate® supports the following Federal forms:

- W-2: Wage and Tax Statement

- W-3: Transmittal of Wage and Tax Statements

- 940: Employer's Annual Federal Unemployment

- 941: Employer's Quarterly Federal Tax Return

- 943: Annual Federal Tax Return for Agricultural Employees

- 944: Employer’s Annual Federal Tax Return

• With an additional cost add-on feature, Payroll Mate® can support the following State forms:

- Illinois Unemployment Insurance and Illinois Withholding Income Tax

- Texas Unemployment Insurance

- NYS-45 (New York Withholding Tax and Unemployment Insurance)

- California DE 9 (Quarterly Contribution Return and Report of Wages)

- California DE 9C (Annual Contribution Return and Report of Wages)

- Florida RT-6 (Florida Reemployment Tax)

- If your state is not listed, simply pull a State Taxes report which provides you with your figures so you can manually fill out your state forms

Operating a municipality can carry its own share of challenges. You must make sure that the residents of your municipality receive the best possible services and that the employees providing those services are paid on time and accurately. Payroll Mate® helps alleviate at least one of those concerns by providing your municipality with the opportunity to process payroll in a more efficient and streamlined manner. As a result, the HR staff handling municipal payroll will be able to save time and effort, thus making your municipality more efficient and productive, which is something that all taxpayers like to see.

These are only some of the features of Payroll Mate. Please refer to the Payroll Mate payroll software page for more details.