Non-Profit Organization Payroll Software

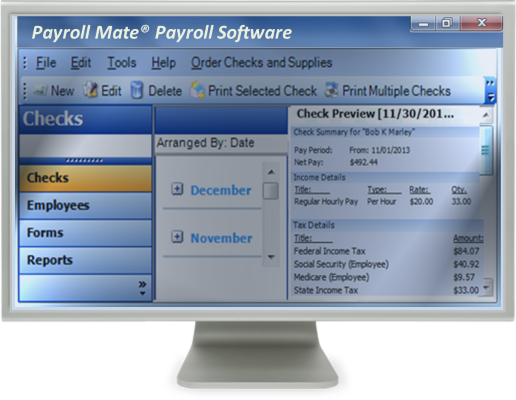

Payroll Mate® makes processing payroll easy and affordable.

Non-profit payroll software for small to medium-size organizations wanting to process payroll in-house quickly and efficiently while saving significant time and money. This locally-installed software can be used on one or multiple networked Windows-based computers.

Free trial is available for immediate download before purchase where you can test adding employees, calculating taxes, creating checks with stubs, generating reports and printing tax forms such as 941s and W2s.

Pay employees in different positions including program coordinators, relationship managers, directors, volunteer recruitment specialists, customer service representatives, activities’ assistants, copywriters, accountants, organizers and other classes of employees.

Our payroll system offers many features that can cater to the special payroll processing needs of a Non-Profit Organization. Ensure that the payroll for your non-profit organization is processed promptly and accurately. Ideal for use by non-profit groups including charities, churches, and other groups. Designed to support multiple pay types and pay frequencies so you can ensure you can process payroll for any type of employee.

For $219 only, process payroll for up to 10 non-profits with up to 75 employees per organization for one calendar year.

Non-Profit Organization Payroll Made Easy

Non-profit organizations function in a much different manner than most organizations. Due to that fact, a non-profit organization will often have different payroll processing and administration needs. In the past, the process of administering payroll could often be complex, time-consuming, and frustrating. With a payroll software solution such as Payroll Mate®, you can ensure that the payroll for your non-profit is processed promptly and accurately without all the hassles. This is because Payroll Mate® is ideal for use by non-profit groups including churches, charities, and other groups. Designed to support both taxable and non-taxable income, Payroll Mate® will also provide support for unique features such as housing allowances. You can even take advantage of the opportunity to withhold or exempt Medicare and Social Security taxes from paychecks as necessary for your non-profit.

Ideal for Churches, Charities, and Other Groups

• Payroll Mate® supports many types of income categories and pay frequencies.

- Pay frequencies include: daily, weekly, bi-weekly, semi-monthly, and monthly.

- Income categories include salary, commission, hourly, and many more.

• Do you need to process payroll with a special income type? This is not a problem with Payroll Mate® since you have the ability to custom create unlimited income, tax, and deduction categories.

• Payroll Mate® is ideal for many types of employees such as part-time, full-time, salary, or seasonal.

• Payroll Mate® is an in-house payroll software that can be installed on a stand-alone desktop computer or run over a network with an additional cost add-on feature.

• Payroll Mate® is designed to work with a number of Windows operating systems including Windows 7, 8, 10, and Windows Vista. You can even run it on Mac with the use of a virtualization technology such as Oracle Virtual Box.

Process Payroll Simply and Quickly

• If you should ever have any questions about using Payroll Mate®, wizards and step by step tutorials are available to guide you through the process.

• You can also receive convenient help via chat, email, and phone if you should have any further questions.

• Payroll Mate® can help to reduce the amount of time that your administrative staff must spend on calculating deductions and withholdings. State and Federal withholdings, Social Security, Medicare, and net pay are automatically calculated.

• Processing and printing checks can be done in a matter of minutes. Pay stubs can also be printed or emailed to your employees so they can always access their payroll information.

• Payroll Mate® also supports tracking of vacation and sick hours. These amounts are easily tracked on employee’s pay stubs.

• Once payroll is complete, you have the option to export payroll data to various accounting software applications such as Intuit QuickBooks, Peachtree Sage 50, Quicken, and General Ledger.

Supports Many Payroll Forms and Reports

• You will find that by using Payroll Mate®, you can ensure that your non-profit is in complete compliance when it comes to issuing federal quarterly and annual payroll forms. Payroll Mate® supports the following Federal forms:

- W-2: Wage and Tax Statement

- W-3: Transmittal of Wage and Tax Statements

- 940: Employer's Annual Federal Unemployment

- 941: Employer's Quarterly Federal Tax Return

- 943: Annual Federal Tax Return for Agricultural Employees

- 944: Employer’s Annual Federal Tax Return

• With an additional cost add-on feature, Payroll Mate® can support the following State forms:

- Illinois Unemployment Insurance and Illinois Withholding Income Tax

- Texas Unemployment Insurance

- NYS-45 (New York Withholding Tax and Unemployment Insurance)

- California DE 9 (Quarterly Contribution Return and Report of Wages)

- California DE 9C (Annual Contribution Return and Report of Wages)

- Florida RT-6 (Florida Reemployment Tax)

- If your state is not listed, simply pull a State Taxes report which provides you with your figures so you can manually fill out your state forms

• Reports are easily accessible and provide you with all of the necessary information that pertains to your payroll. Some reports include Tax Liability, Journal Summary, Deposit Requirement, Taxes & Deductions, Employee Earnings, and many more.

Data is Always Secure

• Lost payroll information could be devastating for your non-profit organization and could even cause you to spend a tremendous amount of time trying to re-enter everything. Since Payroll Mate® provides an automatic reminder to back up, you can rest assured that all of your information will be safe and you can easily restore a backup if needed.

• Payroll Mate® helps you to safeguard your confidential payroll data by providing the option for a password login to the program. You can also mask your employee’s Social Security number on printed pay stubs for added security.

Operating a non-profit organization is rewarding, but it can also come with unique challenges. Payroll Mate® is designed to help ensure that you can administer payroll in a seamless manner without it detracting time and resources from your non-profit organization. With a payroll software solution such as Payroll Mate®, you can ensure that the payroll for your non-profit is processed promptly and accurately without all the hassles.

These are only some of the features of Payroll Mate. Please refer to the Payroll Mate payroll software page for more details.